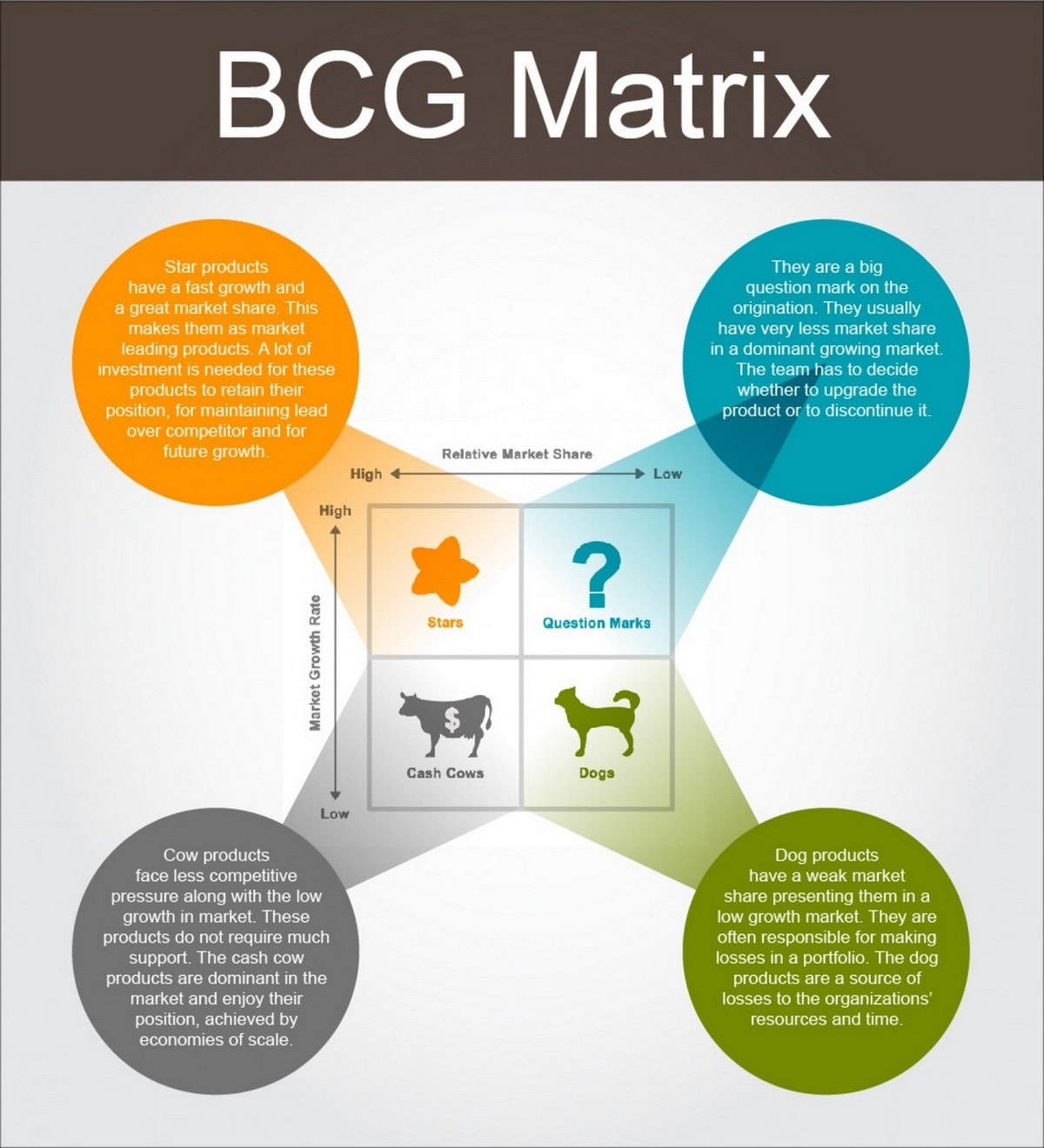

The Success Sequenceīruce Henderson, founder of BCG, in his Product Portfolio, explained how in a successful sequence of cash allocation, stars over time become cash cows.Īnd the abundant cash generated by cash cows will be invested back in question marks, which will need, over time, to become stars, to trigger a positive loop. However, they will have high market shares, thus becoming more stable products, requiring diminishing investments and high cash generation. Yet, they will become large cash generators only when they will turn into cash cows, as their growth rate will slow down. While they are leaders, they generate substantial cash. Stars are high-share, high-growth products. The only way out is if they become stars. They require far more cash than they can generate. Question marks are low market share and high growth products. Pets are those products that don’t have growth potential, and they don’t generate enough cash to be sustained.Īs Bruce Henderson explained in his piece, all products either become cash cows or pets. Pets (dogs)ĭogs are products with low market share and slow growth. They generate cash in excess of what it takes to maintain the market share.Īccording to The Product Portfolio theory, cash should be invested back in cash cows only to maintain them, but most of the excess cash produced by cash cows should be invested in new products (question marks, see below), which have the potential to become cash cows in the future.

An Entire MBA In Four Weeks By FourWeekMBA.100+ Business Models Book By FourWeekMBA.

0 kommentar(er)

0 kommentar(er)